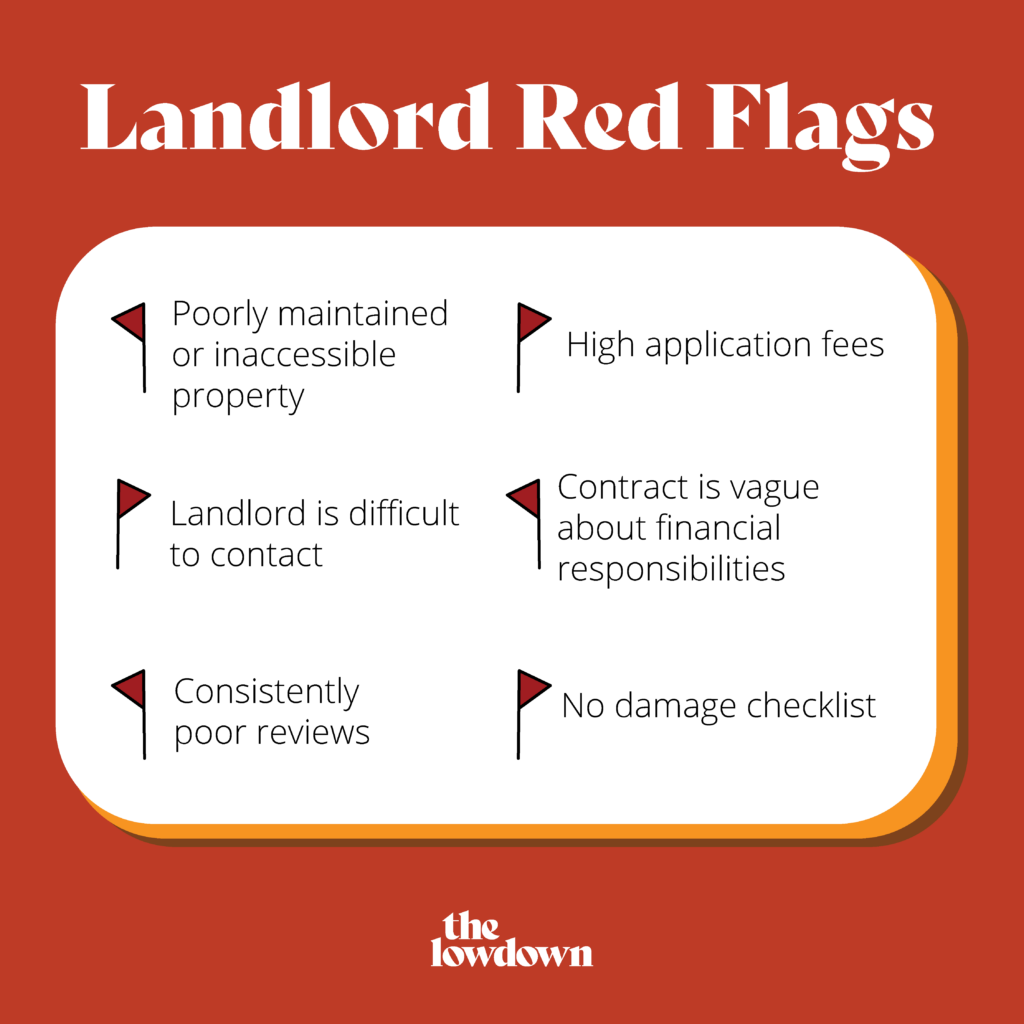

Navigating the rental process as a beginner can be intimidating. There are many factors that need to be considered, including pricing, location, amenities, et cetera, but before signing a lease it’s also important to get a sense for the landlord that owns the property. Contracting with an unscrupulous landlord can be financially dangerous, and it is always prudent to do some research before committing to a lease. Keep an eye out for common red flags while you’re searching for an apartment.

Red Flag: Poorly maintained or inaccessible property

A good starting point is simply checking out the condition of the property itself, including both the exterior and the condition of the apartment itself. A poorly maintained property suggests a landlord who is distant, apathetic, or who lacks the resources to maintain a livable space. Especially watch out for signs of mold or pest damage. It is a serious red flag, and is likely a scam, if you are denied any chance to see the property before signing a lease.

Red Flag: Landlord is difficult to contact

It may also be good to understand what type of landlord owns the property. Smaller complexes or houses often have a single owner, who may also reside at the property. Larger complexes are usually owned by a management company, which might also own other properties as well. Either way, it should be very clear how to contact the landlord or property manager (office location and hours, phone numbers, email). A landlord who is difficult to access, or who resides out of state, is a bad sign.

Red Flag: No damage checklist, no background check, high application fees

Normally upon move-in a landlord will provide you with a checklist to account for existing damages to the property. Be sure to fill this out carefully to avoid being charged for damage that was not your fault. (You should be concerned if the landlord does not provide a damage checklist).

A background or credit check is a normal part of the application process and is a green flag. The absence of a background check suggests the landlord may be trying to lure in and exploit people with bad credit.

Also be wary of unusually high application fees. Application fees are normal and are sometimes paid as a non-refundable portion of the deposit. They are tightly regulated in some states (though not in Utah). It is another red flag if the landlord wants you to pay the application fee through an atypical method, such as Venmo.

Red Flag: Contract seems open to interpretation on financial responsibilities

Just like any salesperson, a landlord is going to talk up the positive aspects of their property and downplay the negatives. You should concern yourself with what’s spelled out in the contract moreover than anything the landlord says. “We’re here to make your new home as wonderful as possible!” is not a legally binding statement; the terms of your lease are.

For this reason, it is always important to read the contract through. Yes, it’s tedious, but this is a legal obligation and should be taken seriously. The landlord is not at fault if you skim the contract without understanding it. If you have any questions or concerns about the terms of the lease, it is important to get these clarified before signing. Once your signature is on the document your options diminish significantly.

Additional fees are normal and not necessarily a sign that the landlord is trying to “trap” you, but it is good to understand beforehand what you may be required to pay. Familiarize yourself with the financial obligations and liabilities spelled out in the lease, such as:

-

- What is covered by rent and what will need to be paid separately (utilities, internet, parking) Also find out if you are expected to pay for maintenance such as plumbing or pest control. If the lease is vague as to who is liable for these costs, the landlord may try to pin the payments on you

- What the deposit is used for and how much of it you can expect to get back. An unusually high deposit, or one that is mostly non-refundable, is a red flag

- What liability you may be assuming for potential damages and repairs to the property, and what fees may be associated. Legally, damage due to “normal wear and tear” is the responsibility of the landlord

- Watch out for unreasonably high fees for late rent. Most landlords will allow a grace period of a few days before charging a late fee. Be careful if no grace period is defined, and/or the late fee is egregiously high (more than 10% of monthly rent).

Each state has different laws governing renter’s rights. If a problem arises it will be useful to know what legal protections you have. You can find more information through the HUD website.

Red Flag: Consistently poor reviews

Another useful resource can be online reviews of the property. Don’t jump to conclusions from the first negative review you see: people with negative opinions are far more likely to publicize them than those with positive opinions. A single negative review does not necessarily represent an average person’s experience. However, you might be concerned if you find an unusual number of negative reviews, and especially if these reviews show a pattern. A single person complaining about hidden fees may simply not have read the contract fully. Many people complaining about hidden fees is a red flag. If you’re investigating a property and looking for thorough reviews from people who’ve lived there, thelowdownutah.com is a great resource to read real reviews from previous or current tenants on the apartment.

Entering into the world of renting can be a daunting step forward, but there’s really no need to worry. A little caution and common sense can go a long way towards keeping yourself safe. Keep these tips in mind, and you’ll be just fine.